How To Build Your Credit Score Fast

Building good credit is super important – someone with a good credit score can save over $100,000 over the lifetime of their mortgage just by having good credit. But building credit can also be a little bit tricky. You need credit to build credit, but without credit, it’s hard to get credit (say that five times fast!). But there are definitely some clear ways to work your way up to an excellent credit score.

So, what is good credit?

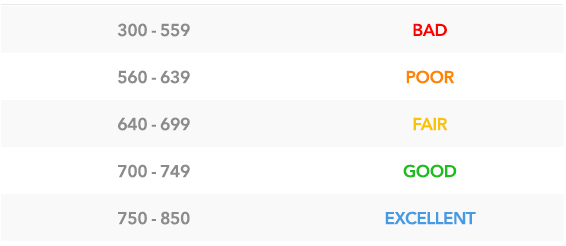

First it is important to understand exactly what “good” credit is. Credit scores range from a low of 300 up to the highest mark of 850. Based on several factors, your credit score will be a number between these two points and will most likely change often. These usually minor changes occur when something is reported to the 3 major credit bureaus and is included on your credit report.

Credit scores are rated as good or bad based on the following general rule:

Now that you know what you should be working towards, it’s time to start improving your credit score. Just follow our step-by-step plan to build your credit score fast.

Now that you know what you should be working towards, it’s time to start improving your credit score. Just follow our step-by-step plan to build your credit score fast.

Step 1: Understand your FICO score

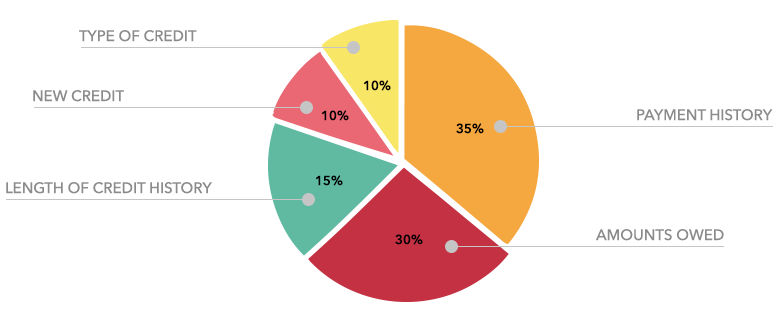

The FICO score is the most commonly used credit scoring model. Your FICO is made up of these five factors:

1. Payment history (35%):

Your payment record accounts for about 35 percent of your total FICO score, according to MyFICO. Maintaining a good on-time payment record is one of the most significant actions that you can take to build your credit. Catching up on accounts that you have allowed to become delinquent will also boost your credit score.

2. Credit utilization (30%):

A lot of people seem to think that as long as they make at least their minimum payments their credit will be fine. Well, if you are maxed out on your credit cards and only making minimum monthly payments, creditors and lenders will understandably conclude that you are having trouble managing your finances. It’s important to keep your debt balances low in relation to your credit limits. Generally, you should keep your credit utilization below 30%.

3. Length of credit history (15%):

Bigger is better! It’s pretty simple, the longer you have maintained a good credit history, the better your score. Your length of credit history is calculated based on the age of your newest account, the age of your oldest account, and the average age of all of your credit accounts.

4. Types of credit in use (10%):

The mix of different kinds of credit accounts (such as auto loans or mortgages) you have will impact your credit in a small way. As a general rule, diversification is better than having only one type of credit account.

5. New credit (10%):

It’s important to limit “hard” credit inquiries. Every time you apply for a credit card or a loan, the lender or credit provider probably obtains a credit report from one or more of the three major credit reporting agencies. Each of these “hard” credit inquiries typically subtracts 5 points from your credit score. One inquiry doesn’t affect your score very much, but it only takes a few “hard” credit pulls to drop your FICO score significantly.

If you are shopping for a new car or in the market for a new house, try to arrange for potential lenders to run your credit within a limited period of time. That’s because credit reporting agencies consider a group of similar credit inquires as a single incident, which limits the adverse effect on your credit score. When you obtain your own credit score, it’s called a “soft” pull. These won’t affect you.

“Soft” pulls can also be used for being pre-approved for a credit card, or when a background check is performed. They also sometimes happen when you apply to rent an apartment, or a car, but not always. If you are unsure, always ask if it will be a “hard” or “soft” pull.

Your credit report contains the data that influences these factors. If you have a social security number then you have a credit report and a FICO score from each of the three major reporting agencies — Experian, Equifax and TransUnion. These reports and scores may vary from one to the next if (a) one of your reports contains an inaccuracy or (b) one of your lenders doesn’t report to one or more of the agencies.

Step 2: Follow good habits for building credit

Practice these good credit habits to build your score and prove that you’re creditworthy:

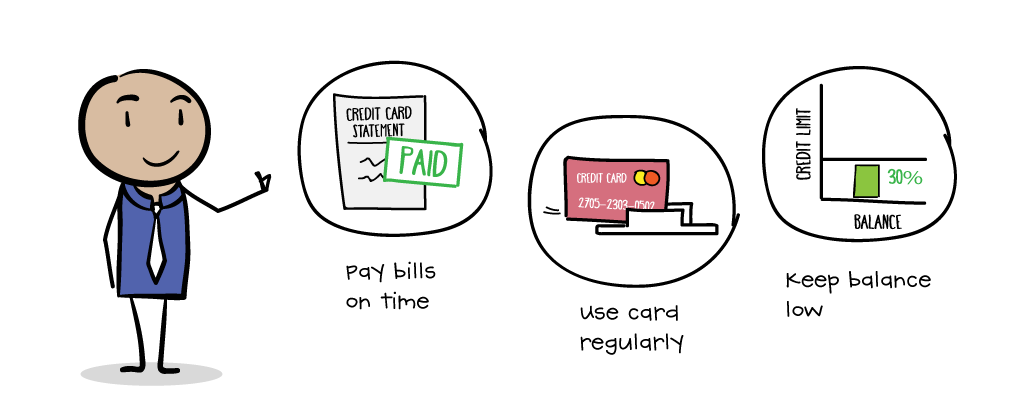

Pay your bills on time!

Make 100% of your payments on time. This is important with credit accounts, but most people don’t realize that the same applies to other accounts, like your utility bills. Bills that go unpaid may be sold to a collection agency, which will hurt your credit.

Keep your credit card debt low.

Don’t let your debt balance exceed 30% of your credit limit at any time. Remember, balances are often reported mid-billing cycle. A high balance means high credit utilization, which will drive down your score.

Ideally, don’t carry a balance.

You should avoid carrying credit card balances altogether if you can. A common credit myth claims that you should maintain small balances on your credit card accounts to prevent card providers from declaring your accounts inactive. The myth is only half right.

It is true that credit card companies evaluate their customers’ accounts for activity and may close accounts that have been dormant for extended periods. This is a good reason to use your credit cards regularly, if only to charge small amounts such as restaurant meals. But there’s no need to carry balances, which only serve to make money for the credit card companies in the form of interest.

Use your card regularly.

Credit accounts that go unused may be closed by issuers after a certain period of time. When an account is closed, your credit utilization will go up and your length of payment history may go down. So if your card issuer sends a notice that they are closing an account, consider calling them and asking them to keep it open.

Keep accounts open for as long as possible.

Unless one of your unused cards has an annual fee, you should keep them all open and active for the sake of your length of payment history and credit utilization.

Avoid opening too many accounts at once.

If you open too many accounts too soon, it will lower your average account age and bring down your score.

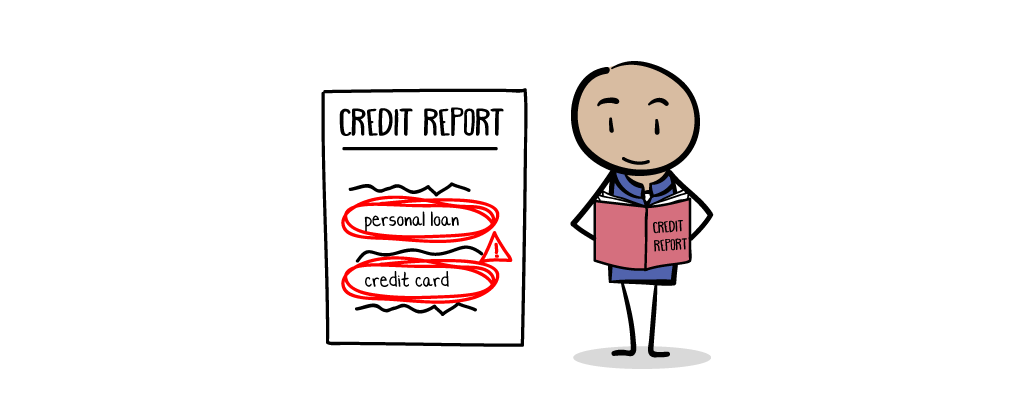

Fix the errors.

Check each of your credit reports annually for errors and discrepancies.

Step 3: Check your credit report and correct errors

Have you checked your credit report lately? If not, you should. A 2012 report conducted by the Federal Trade Commission stated that 5 percent of all Americans had errors on their credit reports that could adversely affect their ability to obtain credit.

Each consumer is entitled one free credit report every 12 months from each of the three major credit reporting bureaus: TransUnion, Equifax and Experian. Links to all three credit reporting agencies can be found on the annualcreditreport.com website.

Beware of commercial websites offering “free” credit scores that require a credit or debit card number. In nearly all cases, such sites offer a “free” trial after which your card will be charged unless you cancel the service. On the other hand, sites such as Credit Karma and Credit Sesame do provide free credit scores with no credit card required. Use SuperMoney to compare your options and find a truly free credit report provider.

Step 4: Build credit with an installment loan or similar

So now that you understand how credit works and how to grow your credit score, it’s time to actually start building credit with a credit account. You have a few options to start building your credit history:

-

Take out a personal installment loan

Another way to begin to repair your credit is by taking a small loan and making on-time payments. Installment loans are great for rebuilding credit because they show creditors you’re capable of responsibly paying back a loan at regular intervals.An innovative lender like LoanNow might be your best option if you chose to go this route. That is because we are more likely to consider your entire financial profile, which may make it easier to be approved for an installment loan from a direct lender.

LoanNow is proud to set a new standard for the lending industry. By looking at the entire person, not just their credit score, we are able to offer installment loans tailored to every credit situation.

Whatever lender you choose, be absolutely sure that the lender reports back to credit bureaus. LoanNow shares all of your good payment history, helping you improve your credit score so that you can qualify for even better loan terms in the future. Many lenders, especially in the subprime space, don’t report to the credit bureaus. But remember, you’ll only benefit if they do.

-

Obtain a secured credit card

If you have no credit history or have made credit missteps in the past, you have some options to establish your credit profile. One of those options is a secured credit card that reports to all three major credit reporting agencies. A secured credit card requires a cash deposit that is used to establish the credit limit for the card. As you use the card, your credit limit decreases. As you make payments, your credit limit is replenished.Secured credit cards look like regular credit cards and operate like regular credit cards – merchants and creditors cannot tell the difference. However, do not confuse secured credit cards with prepaid cards, which operate like bank debit cards and which are not reported to credit reporting agencies.

-

Get a cosigner on an unsecured card

Don’t have the money for a secured card or just want to skip ahead to a regular one? Well then you’ll probably need a cosigner. Remember, your cosigner’s credit may be tarnished if you don’t use your card responsibly, so make your payments on time and don’t max out the card. If you’re looking for an installment loan and can’t find someone to co-sign the entire loan, try splitting the co-sign into pieces with LoanNow’s group-signing. -

Become an authorized user

A family member or significant other may be willing to add you as an authorized user on his or her card. As an authorized user, you’ll enjoy access to a credit card and you’ll build credit history, but you aren’t legally obligated to pay for your charges. You’ll need to have the primary cardholder ask their issuer if authorized user activity is reported to the bureaus. It generally is, but you’ll want to make sure, otherwise your credit-building efforts will be a big waste of time.

-

Borrow from yourself

This is the easiest method to establish your own credit history without a credit card. Buy a Certificate of Deposit (CD) from a bank. Then take out a secured loan against the CD for the same amount of time. Put the money you borrowed in a high-yield checking account. Then use the money you borrowed to payback the secured loan. You’ll be establishing a credit history and earning interest on your checking account and CD. Of course, you’ll need some startup capital to do this.

Step 5: Be patient

Slow and steady wins the race!

If you’re building your credit profile for the first time, you should expect to see results within six months to a year. Rebounding from a credit setback may require two years. Unfortunately, it doesn’t take very long to destroy a good credit rating, but rebuilding one can take a very long time. Serious credit problems such as bankruptcy remain on your credit report for up to a decade, but their adverse effects fade with time. Creditors and lenders are much more concerned with your good payment record over the past year than with a bankruptcy 5 years ago. The key is to maintain a positive credit profile going forward.

So remember to be patient because building credit takes time, but it will happen as long as you’re making the right credit moves.